Industries

Home / Industries

Industries We Serve

At Lions Accounting & Tax Services LLC, we understand that every industry faces unique financial challenges, regulatory requirements, and growth opportunities. That’s why we tailor our tax planning, accounting, and advisory services to meet the specific needs of the sectors we serve—delivering clarity, compliance, and strategic insight at every stage.

Whether you’re a solo entrepreneur or a multi-entity corporation, our team brings deep industry knowledge and credentialed expertise to help you thrive.

Healthcare & Medical Professionals

From physicians and dentists to clinics and wellness providers, we help healthcare professionals manage complex income structures, optimize deductions, and stay compliant with evolving tax laws.

Professional Services

Law firms, consultants, engineers, and other service-based businesses rely on us for accurate bookkeeping, strategic tax planning, and entity structuring that supports long-term growth.

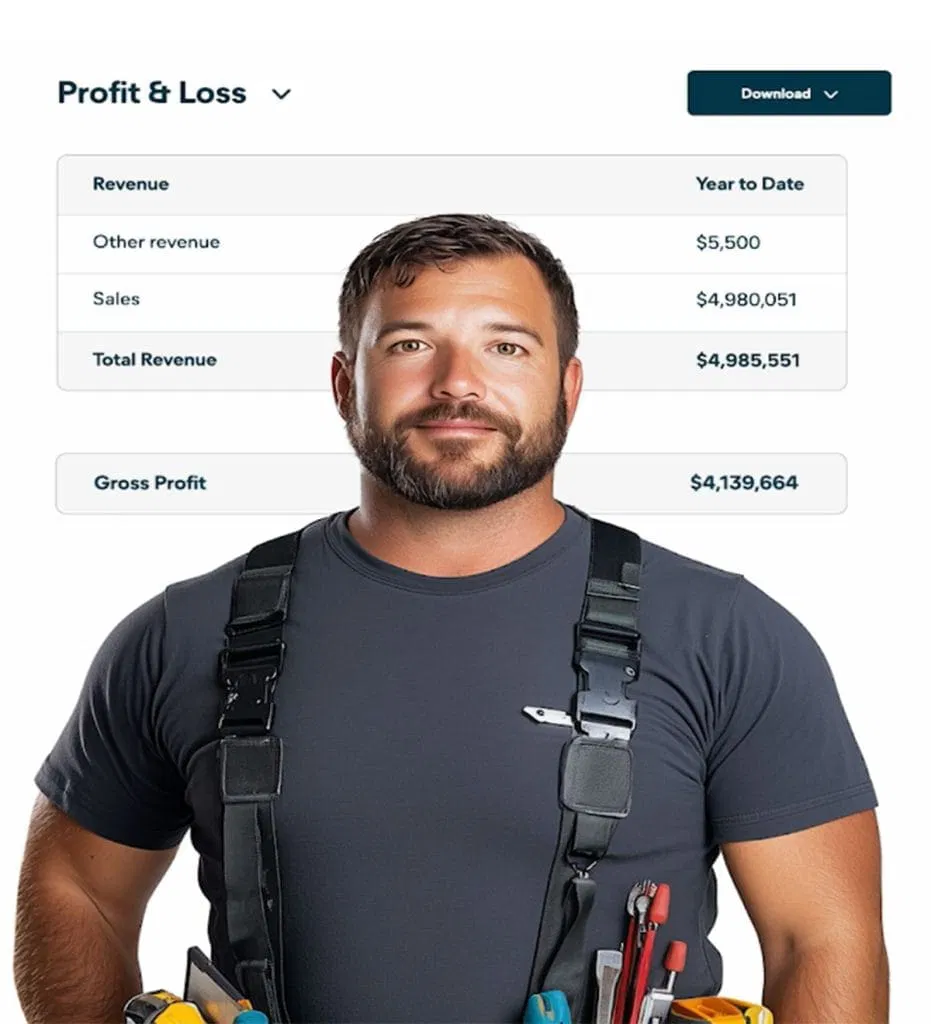

Construction & Trades

We support contractors, builders, and skilled trades with job costing, payroll management, GST/HST compliance, and seasonal tax strategies.

Retail & E-Commerce

Brick-and-mortar stores and online sellers benefit from our expertise in inventory tracking, multi-jurisdictional sales tax reporting, and cash flow optimization.

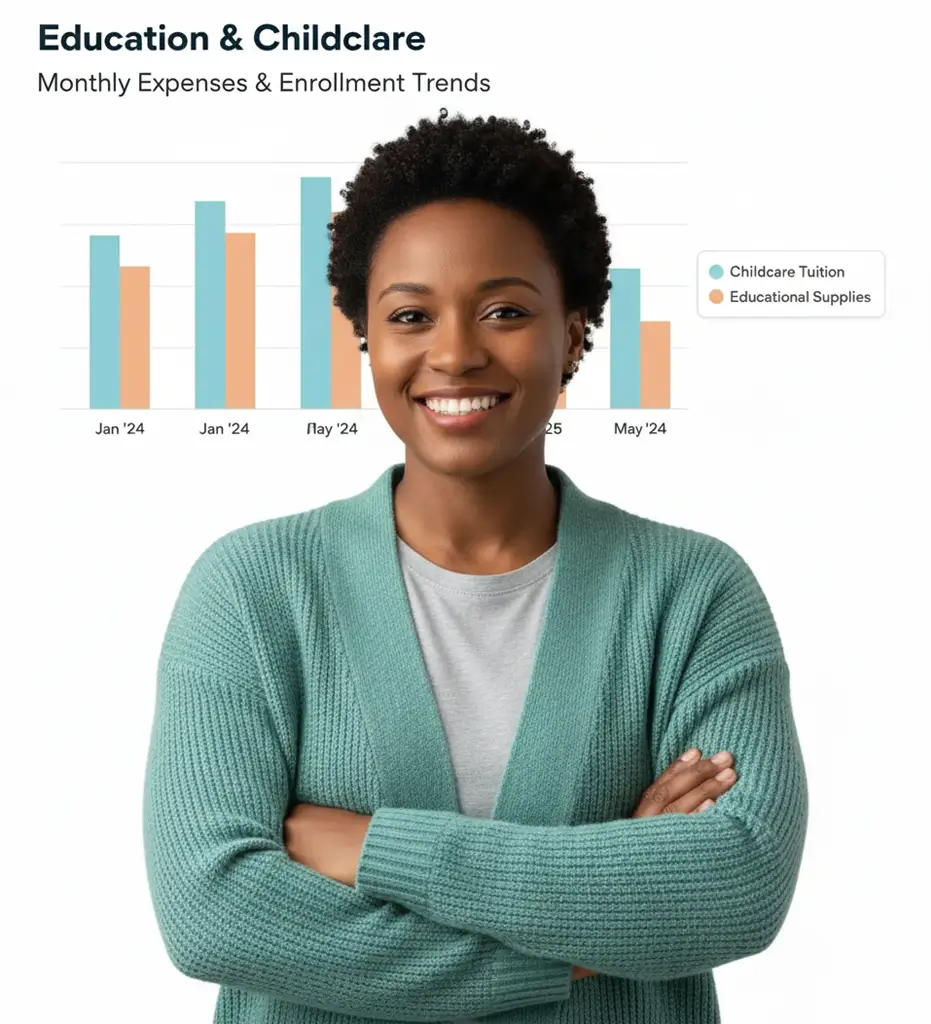

Education & Childcare

Private schools, tutoring centers, and daycare providers trust us to manage payroll, nonprofit filings, and government reporting requirements.

Real Estate & Property Management

We assist agents, brokers, investors, and property managers with rental income reporting, cost segregation, and capital gains strategies.

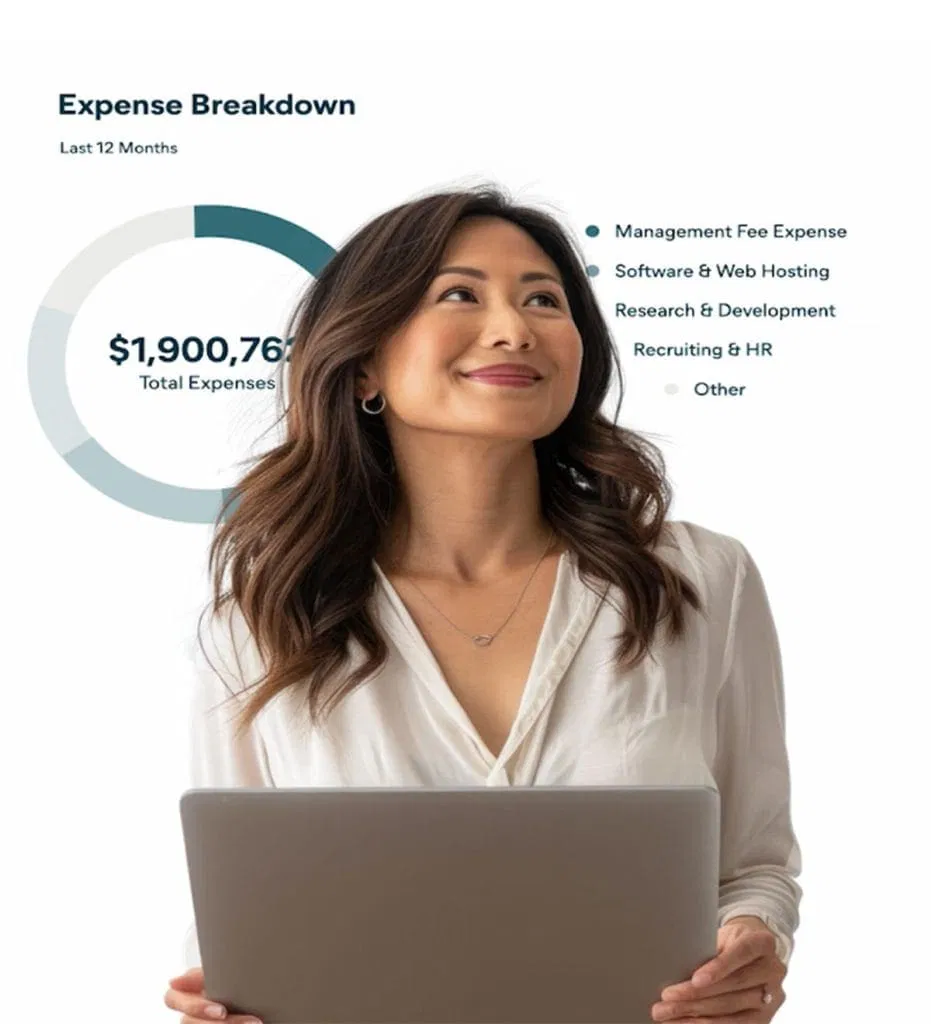

Technology & Startups

Tech firms and SaaS companies turn to us for R&D credit optimization, cross-border tax planning, and scalable accounting systems.

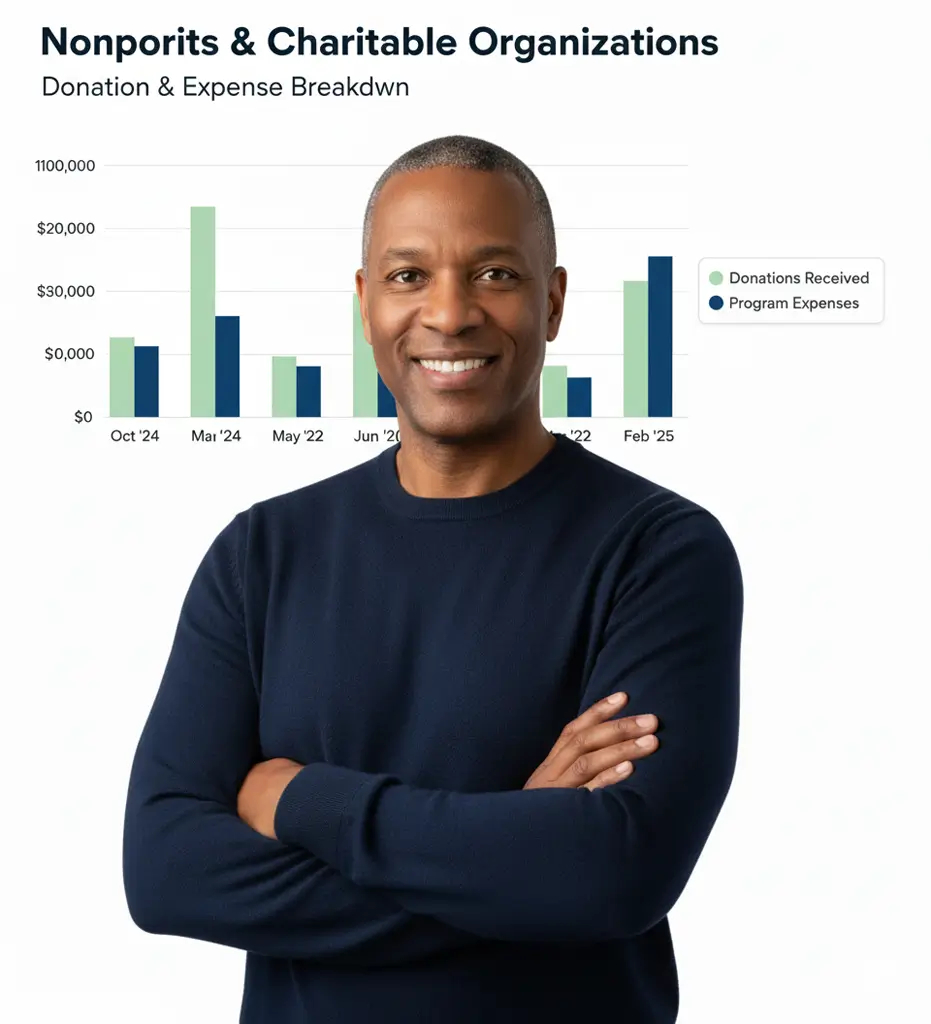

Nonprofits & Charitable Organizations

We help nonprofits maintain tax-exempt status, file accurate returns, and meet CRA and IRS compliance standards with confidence.

Transportation & Logistics

Owner-operators and fleet-based businesses rely on us for mileage tracking, fuel tax credits, and industry-specific deductions.

Individuals

Whether you’re a salaried employee, a freelancer, or managing multiple income sources, our team ensures your taxes are filed accurately and your finances are optimized.

Services for Individuals:

- Personal Tax Preparation

- Financial Planning

- Retirement Strategy

- IRS/CRA Representation

- Tax Relief Support

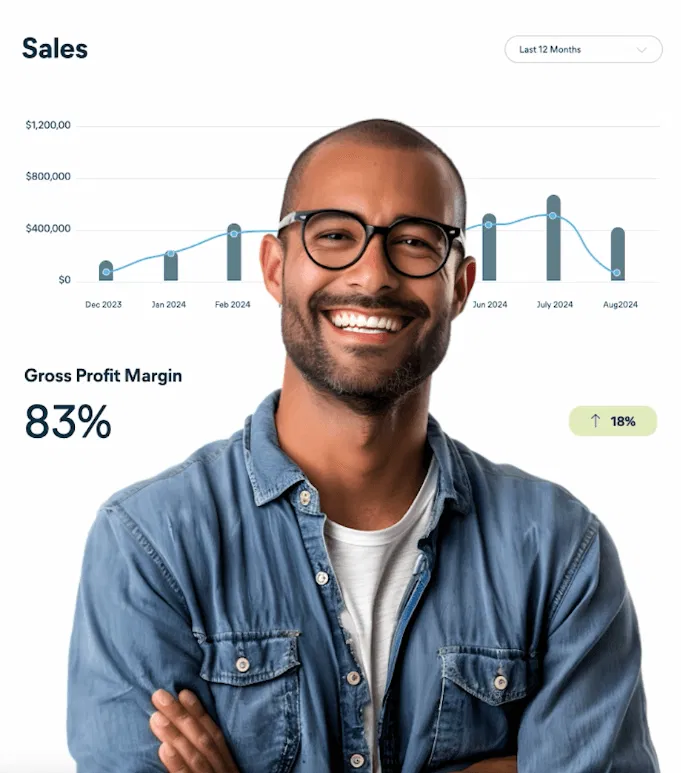

Small Businesses

Running a small business is rewarding—but also full of financial responsibilities. We partner with small business owners to streamline bookkeeping, manage taxes, and support compliance from startup to growth.

Services for Small Businesses:

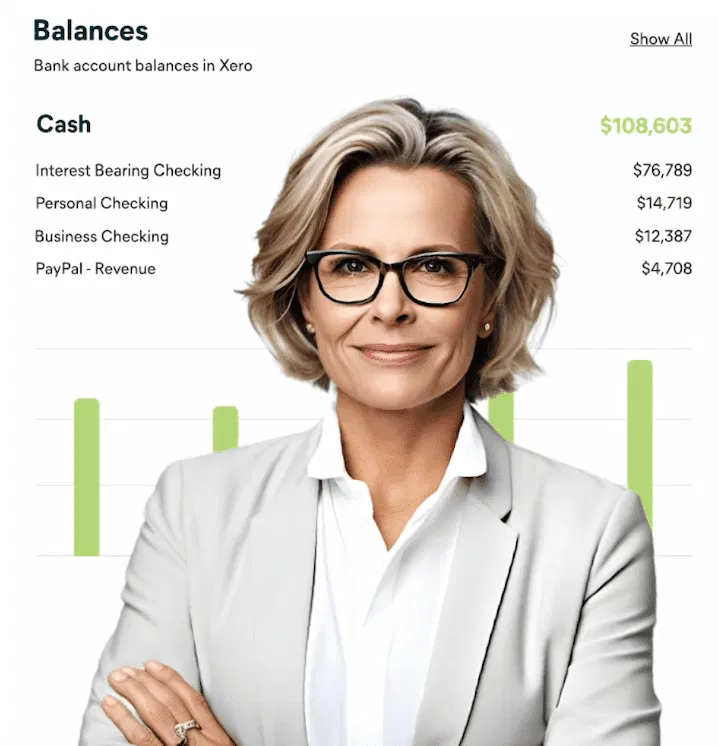

- Bookkeeping & Payroll

- Business Tax Filing

- CFO Services

- Business Advisory: Starting from $200/hour

- Business Formation & Licensing

- Financial Advisory

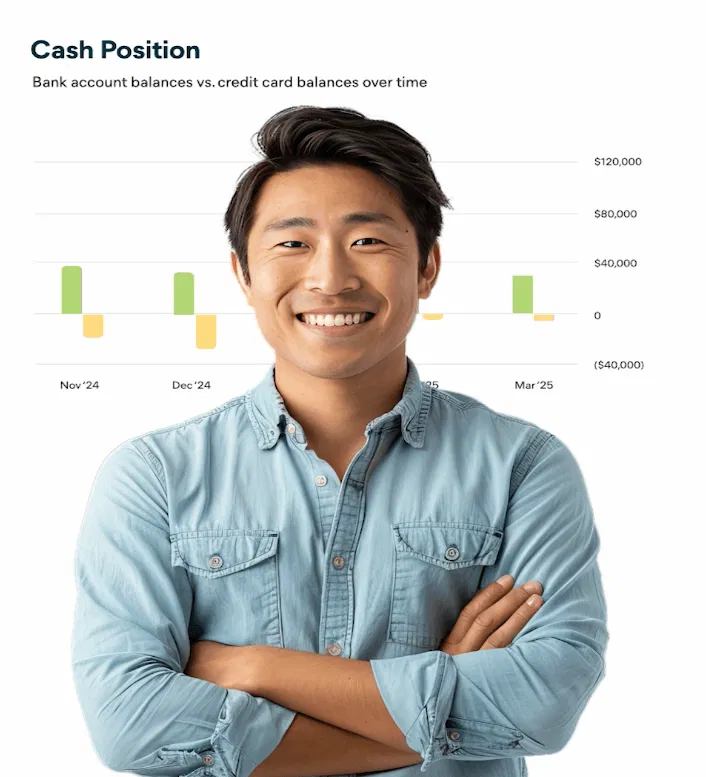

Medium Enterprises

For growing businesses with complex operations, we offer strategic financial management, tax structuring, and performance reporting tailored to your needs.

Services for Medium Enterprises:

- Customized Financial Planning

- Tax Strategy & Compliance

- Audit Preparation & Forensic Accounting

- Multi-Entity Bookkeeping

- Advisory Services